New to Budgeting? Try This Simple Budget Template for Beginners

Budget Template Download

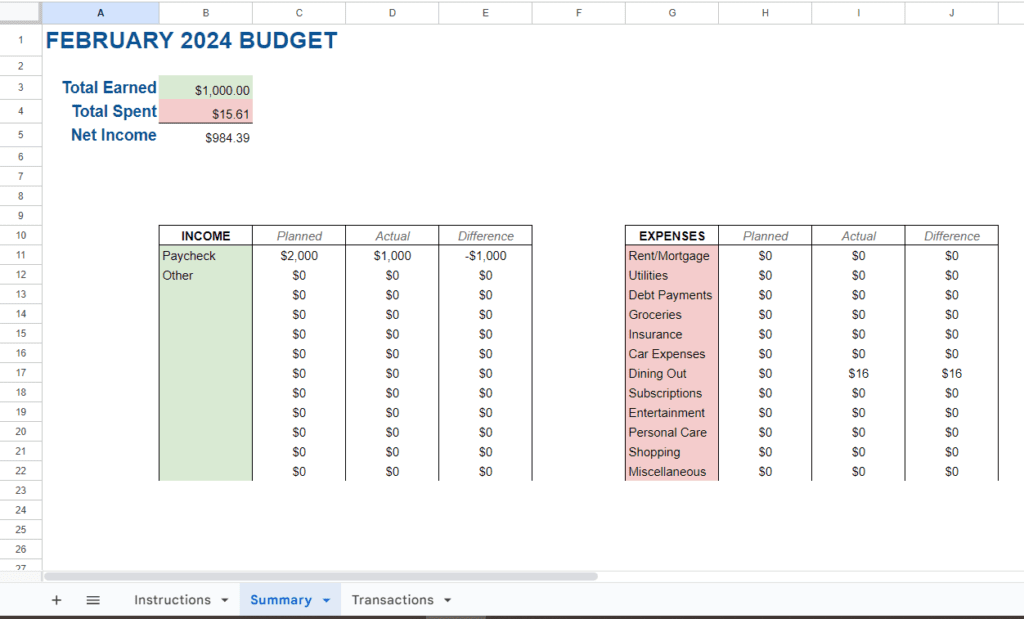

Here I have put together a simple budget template that you can download and use to start tracking your cash flow. The first tab has the instructions you need to use it, but please feel free to email me if you have any additional questions!

I hope that once you get the hang of tracking your spending, it will actually give you a sense of peace of having more control over your money. It can be really fun to hit your savings goal every month and see your nest egg growing!

Why do I need a budget?

If you’ve never done a budget or tracked your spending before, you might be having thoughts like:

- Why do I need a budget anyway?

- Tracking my spending sounds like another task that I don’t have time for.

- Budgeting seems so restrictive.

- If I’m already spending the bare minimum, how will setting a limit on my expenses each month help me?

These are valid thoughts and questions, and I personally think that budgeting gets a bad rap as something only control freaks do to keep track of every cent.

The truth is, the main thing that you want to obtain from budgeting is clarity about your finances. Most people have no idea how much money they’re spending each month, or even how much money their bringing home from their jobs!

Once you keep a budget for about 3-6 months, you will have a very clear idea of your financial position, such as roughly how much money you spend each month. This kind of information is invaluable for setting goals for your money, such as wanting to build an emergency fund.

The common advice for an emergency fund is to save about 3 to 6 months of your monthly expenses, so how can you possibly do that if you don’t know how much you spend each month?

The bottom line is that if you want to go somewhere, you need to start with knowing where you are right now before you can figure out where you’re going. Budgeting will help you do just that with your finances!

How to Track Your Spending

Keeping track of how you’re spending your money doesn’t have to be as daunting as it sounds! Essentially, you’ll want to look at your bank statement each day (or even other day) and record how much money came in or how much money you spent on something.

This can be done in just 5 minutes a day if you keep up the frequency – or, if you have a little more time on the weekends, you can sit down once a week and spend about 20 minutes figuring out everything you spent or earned that week.

For each transaction, you’ll want to record the date, amount, vendor (such as Chick-Fil-A, the name of the company you work for, etc.), and the amount. Then, you’ll want to categorize it with either an income or an expense category.

That’s it! The spreadsheet will do the rest of the work and total up how much you spent on each category, essentially putting your money into different “buckets.”

Your Income Categories

These are the categories that you will use anytime you make money. Think of simple things like your paycheck or money paid from loans. Below are some examples of income categories:

- Paycheck

- Loan payments

- Allowance

- Inheritance

- Gifts

- Child Support

- Rental Income

- Dividend Income

- Interest Income

Especially for beginners, I recommend keeping this very simple in the beginning. When I first started budgeting, my only income category was my paycheck. Any other money I received I either put straight into savings or considered it as “fun money” that I didn’t need to keep track of.

Your Expense Categories

After you know how much and where your income is coming from, the next step is to figure out your expenses, or how much you’re spending each month. There are hundreds of expense categories depending on how nitty-gritty you want to get with them – again, I recommend keeping it simple when you are just starting out. Some of the categories I use are:

- Rent/Mortgage

- Utilities

- Electricity

- Groceries

- Dining Out

- Car Expenses (Gas, Repairs, etc.)

- Debt Payments

- Personal Care (Medical expenses, hair/nail appointments, etc.)

- Subscriptions (Gym, Netflix, etc.)

- Insurance

- Entertainment

- Misc. (a “catch-all” for one-off expenses)

As you’re tracking your expenses, put them into each of these categories so you can see how much you’re spending in each area. This can be very eye-opening and you might find that there are areas where you can easily cut back, such as subscriptions you don’t use any more.

Your Savings & Investments

Now that you have your income and expenses figured out, it’s time to see how much money you have left over at the end of each month. With whatever money is left, I recommend putting it in savings or investing it into low-cost index funds, such as VOO (the Vanguard S&P 500 ETF).

If you’re really serious about starting to save money, the absolute best thing you can do for yourself is to treat your savings like a non-negotiable expense category. This means you “pay yourself” just like you would pay any other bill as soon as you get paid.

10% of your take-home pay is a great savings goal to start with, but if you can’t quite manage that yet, start with whatever you can.

Another thing to note: don’t be worried if you start off “in the red,” meaning you are currently spending more than you make each month.

Awareness is the first step to taking control of your money, so remember that you’re just starting out! Once you have clarity on your financial position, it will be much easier for you to figure out how you can cut expenses (or even better, make more money!).